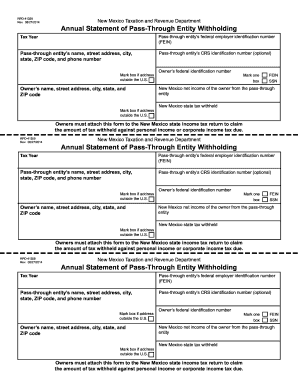

Who needs an RPD-41359 form?

This form is used by the pass-through entities of New Mexico which are subject to reporting and withholding New Mexico tax from each owner’s share of the net income. The form is prepared by the pass-through entity for each owner of the entity.

What is the purpose of the RPD-41359 form?

The annual statement is required to prepare the New Mexico state income tax return by the owners of business entities. This form provides the information about the New Mexico tax withheld from the income of each owner. If the owner didn’t receive income, the pass-through entity doesn’t have to file this form.

What other forms and documents must accompany the RPD-41359 form?

The owner of the business entity must attach this statement to the New Mexico state income tax return. This form can be substituted by the form 1099-MISC or pro forma form 1099-MISC. The pass-through entity has to attach the RPD-41367 to this statement.

When is the RPD-41359 form due?

This statement is to be sent to the owners by the 15th of February for the appropriate fiscal year. The entity's owner must file this form together with the New Mexico income tax return.

What information must be provided in the RPD-41359 form?

The annual statement asks for the following information:

- Tax year

- Federal employer identification number of the pass-through entity

- CRS identification number of the pass-through entity

- The identification number of the owner

- Name, address of the pass-through entity

- Name, address of the owner

- New Mexico state tax withheld from the income

- New Mexico net income of the owner

What do I do with the RPD-41359 form after its completion?

The statement form is sent to the owner.